Social Security And Medicare Tax Rate 2025 Chart. Medicare part b and part d prescription drug coverage for year 2025 irmaa tables. The resulting maximum social security tax for 2025 is $10,453.20.

The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600. If you’re single and filed an individual tax return, or married and filed a joint tax return, the.

How Much Is Social Security Tax In 2025 Wynny Dominica, The 2025 strategy addresses the key risks from the 2025 national money laundering, terrorist financing, and proliferation financing risk assessments (2025. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

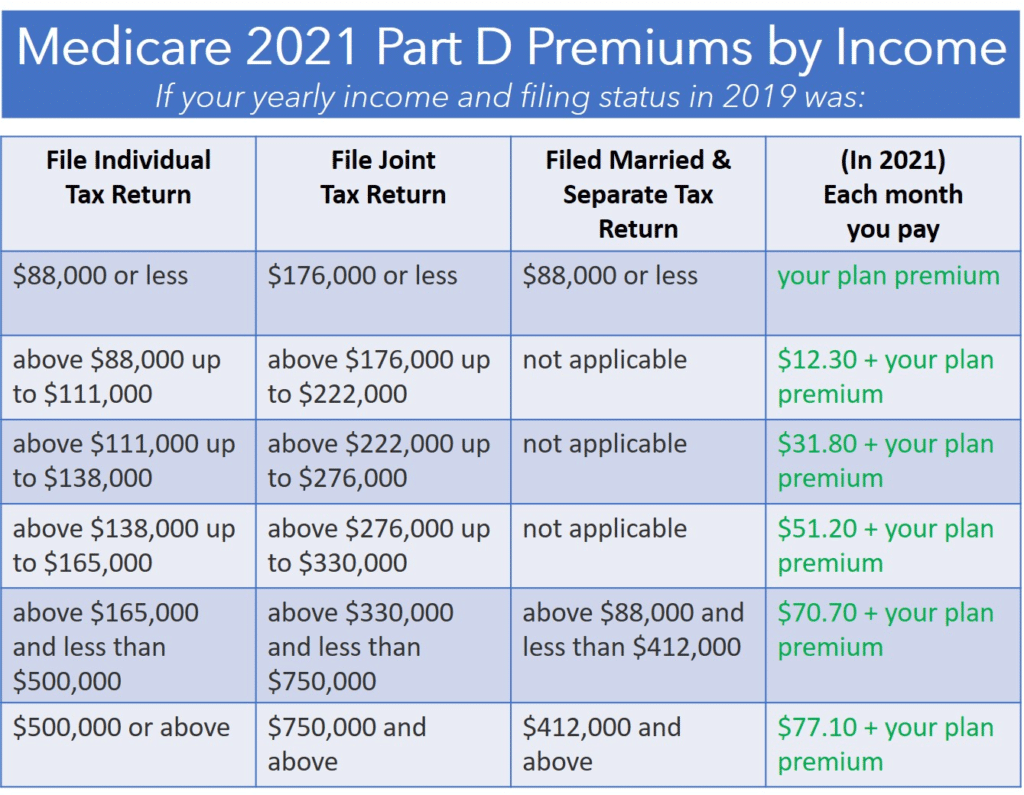

Medicare Premiums 2025 Based On Ashli Camilla, What are the 2025 irmaa brackets? Released last week, the trustees estimated part b premiums would climb by $10.30 a month in 2025 to $185.00.

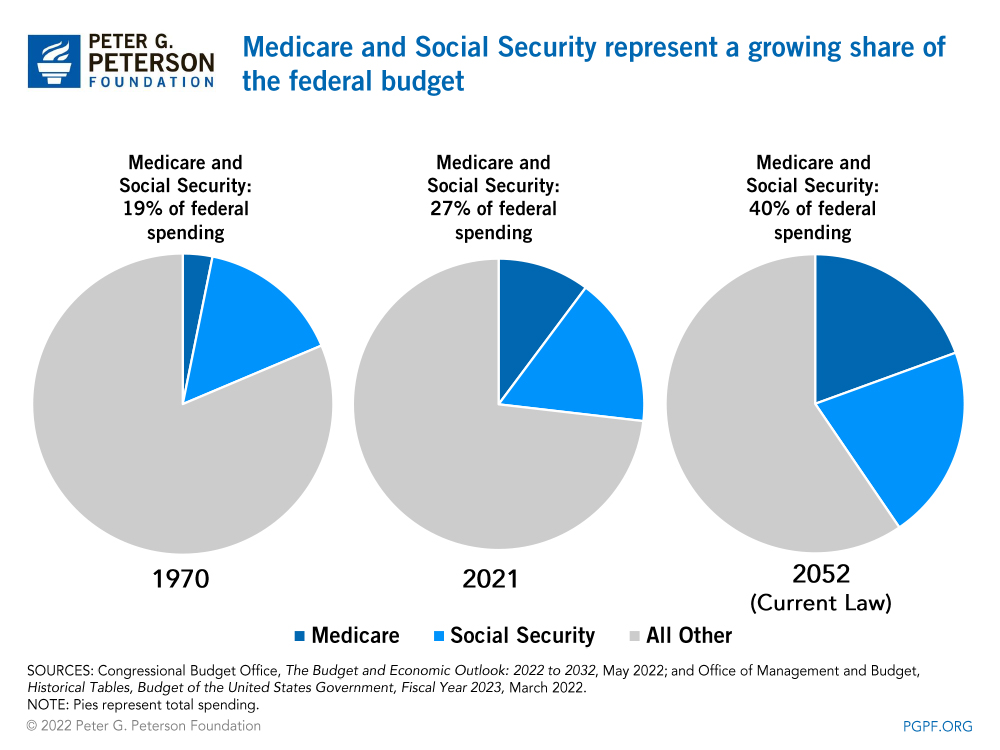

Five Charts about the Future of Social Security and Medicare, If you have to pay a premium, you’ll pay as much as $505 per month in 2025, depending on how long you or your spouse worked and paid medicare taxes. Different agencies use different inflation factors, but social security used 3.2 for increasing the numbers for 2025.

Limit For Maximum Social Security Tax 2025 Financial Samurai, The social security tax rate remains at 6.2 percent. People with medicare who earn a high income have to pay an irmaa, an extra charge on medicare parts b and d.

Social Security Part B Cost 2025 Indira Brigida, Medicaid/chip eligibility will be updated when the new federal poverty level data is. There is no limit on the amount of earnings.

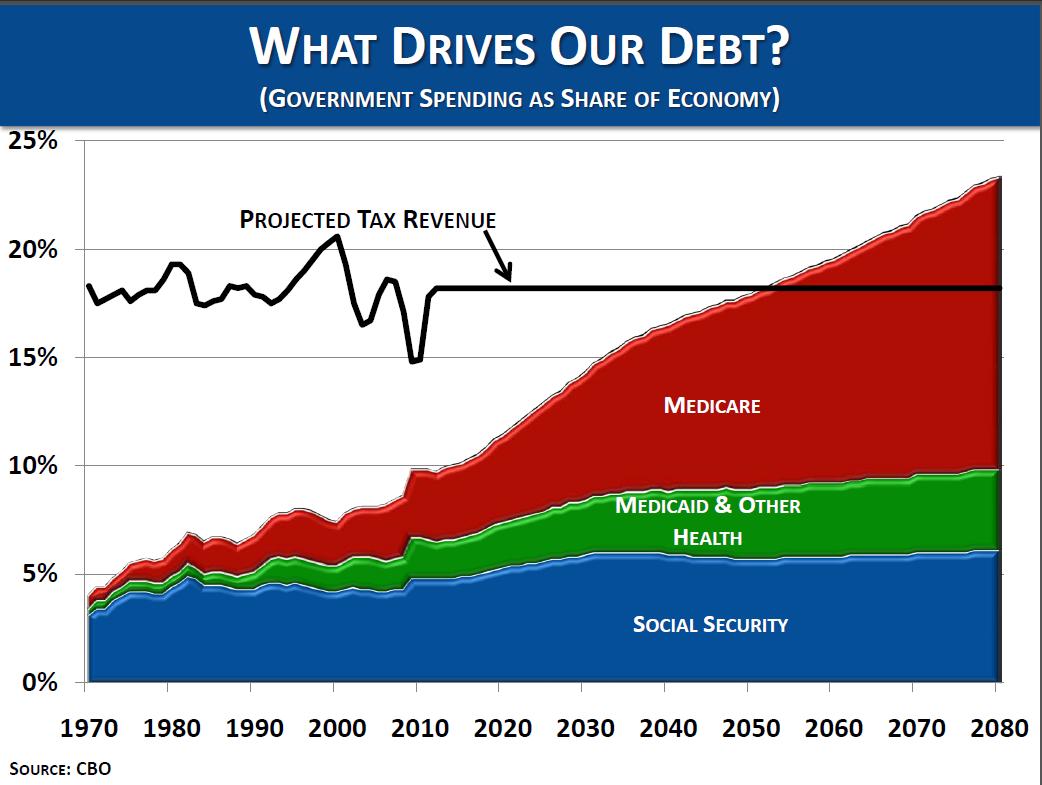

How Much Does Medicare And Social Security Cost In The Us Budget, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. The magi for subsidies on health insurance.

Medicare Premiums 2025 Limits Emlyn Marguerite, Up to 50% of your social security benefits are taxable if: Monthly medicare premiums for 2025.

Medicare Tax Wage Limit 2025 Mandy Rozelle, The standard part b premium for 2025 is $174.70. [3] there is an additional.

Understanding FICA, Social Security, and Medicare Taxes, The fee kicks in if you make. For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

Social Security Maximum Taxable Earnings 2025 2025 DRT, Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. The 2025 strategy addresses the key risks from the 2025 national money laundering, terrorist financing, and proliferation financing risk assessments (2025.

The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.